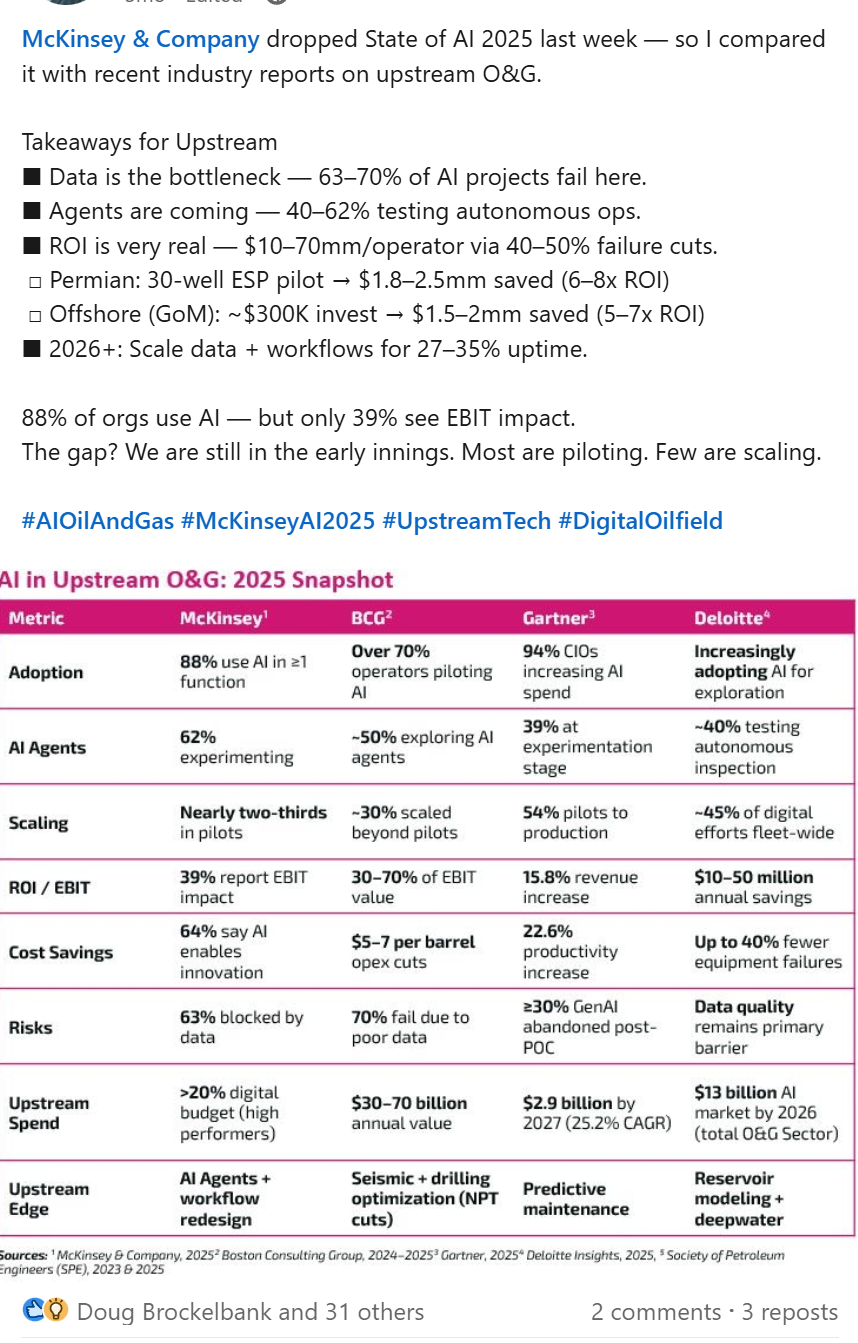

McKinsey dropped their State of AI 2025 report last week — so I compared it with recent industry reports on upstream O&G from BCG, Gartner, and Deloitte to build a picture of where upstream oil and gas actually stands on AI adoption.

Takeaways for Upstream:

- Data is the bottleneck — 63-70% of AI projects fail here.

- Agents are coming — 40-62% testing autonomous ops.

- ROI is very real — $10-70mm/operator via 40-50% failure cuts.

- 2026+: Scale data + workflows for 27-35% uptime.

88% of orgs use AI — but only 39% see EBIT impact. The gap? We are still in the early innings. Most are piloting. Few are scaling.

AI in Upstream O&G: 2025 Snapshot

| Metric | McKinsey | BCG | Gartner | Deloitte |

|---|---|---|---|---|

| Adoption | 88% use AI in ≥1 function | Over 70% operators piloting AI | 94% CIOs increasing AI spend | Increasingly adopting AI for exploration |

| AI Agents | 62% experimenting | ~50% exploring AI agents | 39% at experimentation stage | ~40% testing autonomous inspection |

| Scaling | Nearly two-thirds in pilots | ~30% scaled beyond pilots | 54% pilots to production | ~45% of digital efforts fleet-wide |

| ROI / EBIT | 39% report EBIT impact | 30-70% of EBIT value | 15.8% revenue increase | $10-50 million annual savings |

| Cost Savings | 64% say AI enables innovation | $5-7 per barrel opex cuts | 22.6% productivity increase | Up to 40% fewer equipment failures |

| Risks | 63% blocked by data | 70% fail due to poor data | ≥30% GenAI abandoned post-POC | Data quality remains primary barrier |

| Upstream Spend | >20% digital budget (high performers) | $30-70 billion annual value | $2.9 billion by 2027 (25.2% CAGR) | $13 billion AI market by 2026 (total O&G sector) |

| Upstream Edge | AI Agents + workflow redesign | Seismic + drilling optimization (NPT cuts) | Predictive maintenance | Reservoir modeling + deepwater |

Sources: McKinsey & Company, 2025; Boston Consulting Group, 2024-2025; Gartner, 2025; Deloitte Insights, 2025; Society of Petroleum Engineers (SPE), 2023 & 2025

Real ROI Numbers

The industry data backs up what we're seeing with operators:

- Permian Basin: A 30-well ESP pilot delivered $1.8-2.5M in savings (6-8x ROI) through AI-driven failure prediction

- Offshore (GoM): ~$300K investment yielded $1.5-2M in saved costs (5-7x ROI)

- Cross-industry: BCG reports 30-70% of EBIT value from AI deployments that actually scale

The common thread: the operators seeing returns invested in their data infrastructure first, then applied AI on top. The ones who skipped straight to the AI model are the ones in the 63% failure rate.

Data First, AI Second

This is the pattern we see over and over. The AI layer only works when the data foundation is solid. Getting accounting, production, reserves, and operational data into a single, validated source is the prerequisite to everything else — whether that's predictive maintenance, autonomous workflows, or simply making better decisions faster.

The upstream sector is still in the early innings on AI. The companies that get the data right now will be the ones positioned to scale when the models catch up.